Home / ESG / Climate Change Responses and GHG Management

RichWave has always paid attention to environmental protection, striving to reach a balance between corporate operations and co-prosperity/co- existence with the environment by launching electronic products featuring exceptional performance and green concepts. Consequently, while materializing the environmental management policy and controlling the environmental impact of our operations, we also pro-actively engage in supply chain and environmental management, supervising and guiding our supply chain partners to fulfill their environmental responsibilities in a bid to create a green semiconductor value chain.

Environmental management goal

Beginning in 2023, RichWave will implement planned electricity use, GHG reduction, and other waste management over the next 5 years to achieve the management policy goal of reduction by 3%.

Lower water use intensity (WUI) by 2% before 2030 compared to 2023.

RichWave's Environmental Management Policy

- Compliance with International Laws – Support Green Environmental Protection

We will continue to monitor changes in domestic and foreign environmental policies and regulations to ensure that the company's operations comply with the law. Launch green products that comply with the international environmental regulations and development trends, as well as satisfy the customers' sustainable requirements. - Implement Environmental Management – Resource Recycling and Reuse

Apply ISO 9001:2015, ISO 14001:2015 and ISO 14064-1:2018 management system to realize total environmental management; electronic wastes are recycled by qualified disposal contractors and reused as resources to unleash the benefits of a circular economy. - Encourage Total Participation – Promote Ongoing Improvement

Continue to promote environmental concepts and education to RichWave's colleagues and support relevant activities by the government and environmental groups; regularly review our environmental performance to examine and improve inadequacies.

Climate Change

With increasing global warming, RichWave is aware that climate change is an urgent issue that must be addressed. According to the World Economic Forum (WEF)'s Global Risks Report in 2023, which identifies 6 climate and environmental risks among the top 10 long-term risks (over the next decade), "inability to mitigate climate change" is considered the most serious risk. The latest 2024 Global Risks Report lists "extreme weather events", "critical change to Earth systems", "biological loss and ecosystem collapse", and "natural resource shortages" as the top 4 global risks over the next 10 years. These risks are all climate-related environmental risks. To cope with the increasingly severe climate crisis, governments worldwide are gradually implementing compulsory regulations that demand businesses to conduct financial impact analysis based on the Task Force on Climate-related Financial Disclosures (TCFD) to evaluate climate risks and opportunities faced by the companies. The Financial Supervisory Commission (FSC) of Taiwan is actively responding to this trend by requiring listed companies to disclose 9 key pieces of information on the impact of climate change in their annual reports starting in 2024, based on the TCFD framework. These requirements include 4 mandatory disclosures, 4 climate scenario analyses, and GHG inventory information.

To keep up with global trends and meet regulatory requirements, RichWave has adopted an ESG strategy focused on green innovation, circular economy, responsible value chain, corporate social responsibility, environmental protection, and sound governance. In early 2022, we implemented the TCFD framework, disclosing our climate governance structure from 4 perspectives: governance, strategy, risk management, and metrics and targets. We established plans and phased targets for lowering GHG emissions, identifying climate-related risks and opportunities that could have a financial impact on the company. Furthermore, we developed response strategies and actions to bolster the company's resilience to climate challenges. In 2023, we expanded our assessment methods by involving more departments in identifying the company's risks and opportunities. We also thoroughly evaluated the financial impacts of material risks and opportunities on the company, both historically and potentially in the future, and devised appropriate strategies and management objectives accordingly. These measures not only enhance RichWave's climate governance capabilities and resilience, minimize the financial impact of climate change on the company, but also hope to contribute to mitigating global climate change.

The 4 Core Elements of TCFD

Governance

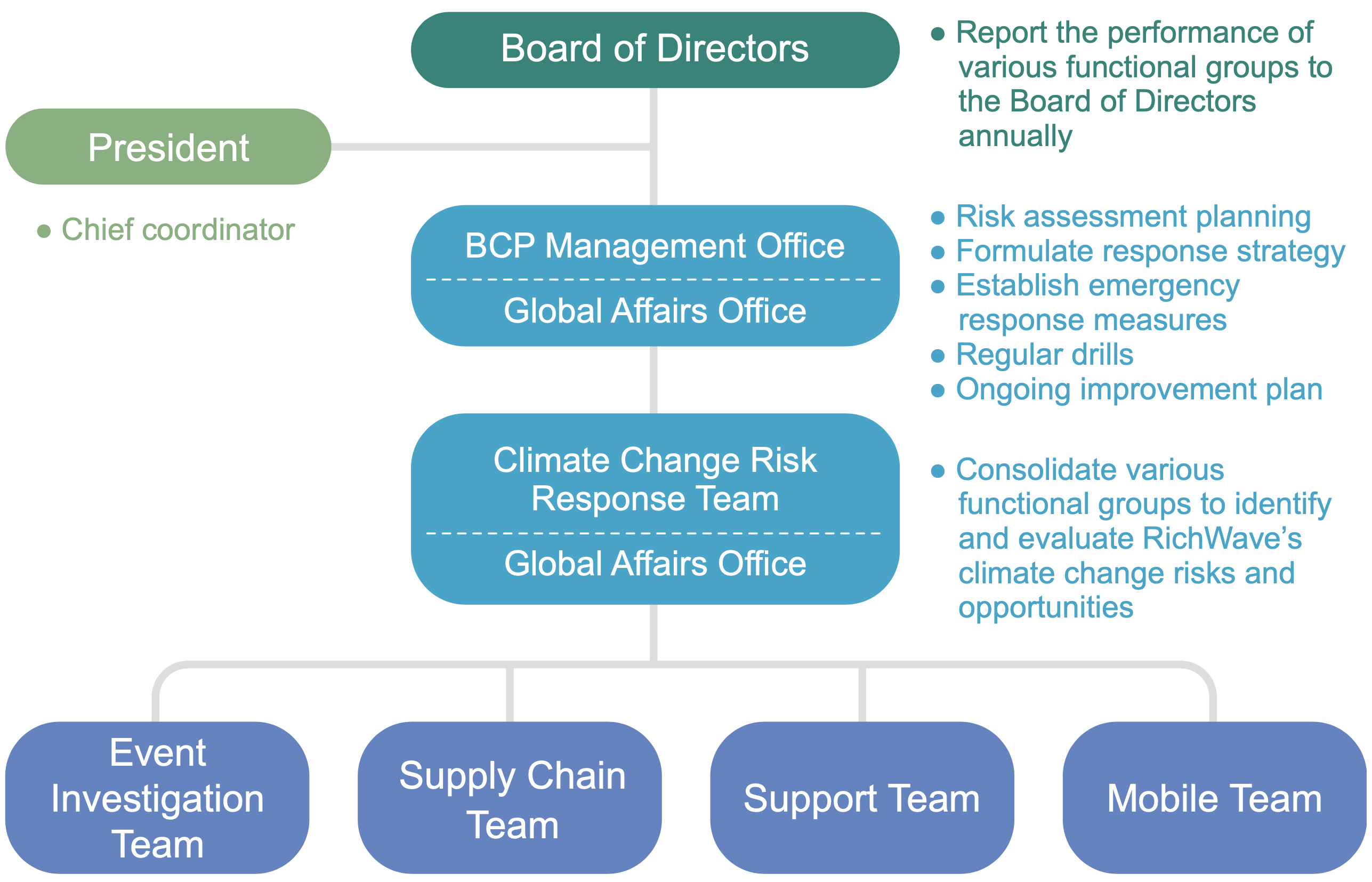

RichWave introduced the Business Continuity Planning (BCP) management model and established the cross-unit "BCP Management Office"as the lead unit responsible for managing the company's climate-related risks and opportunities, as well as formulating and implementing risk management strategies and action plans, and conducting the annual risk and opportunity identification. The BCP Management Office is overseen and supervised by the Board of Directors, with the President serving as the convener and members consisting of representatives from various business units. The BCP Management Office includes a "Climate Change Risk Response Team", which is subdivided into the Event Investigation Squad, Supply Chain Squad, Support Squad, and Task Force Squad. The President serves as the chief convener of the BCP Management Office, while the Global Affairs Office is in charge of policy, planning, and promotion, with each team coordinating and communicating across departments to ensure oversight and execution. To carry out effective risk evaluation and management, the BCP Management Office will complete the risk identification, formulate management goals, implement response plans, and present the outcome to the Board of Directors for supervision and guidance.

RichWave's Climate Governance Organizational Structure:

2. Risk Management

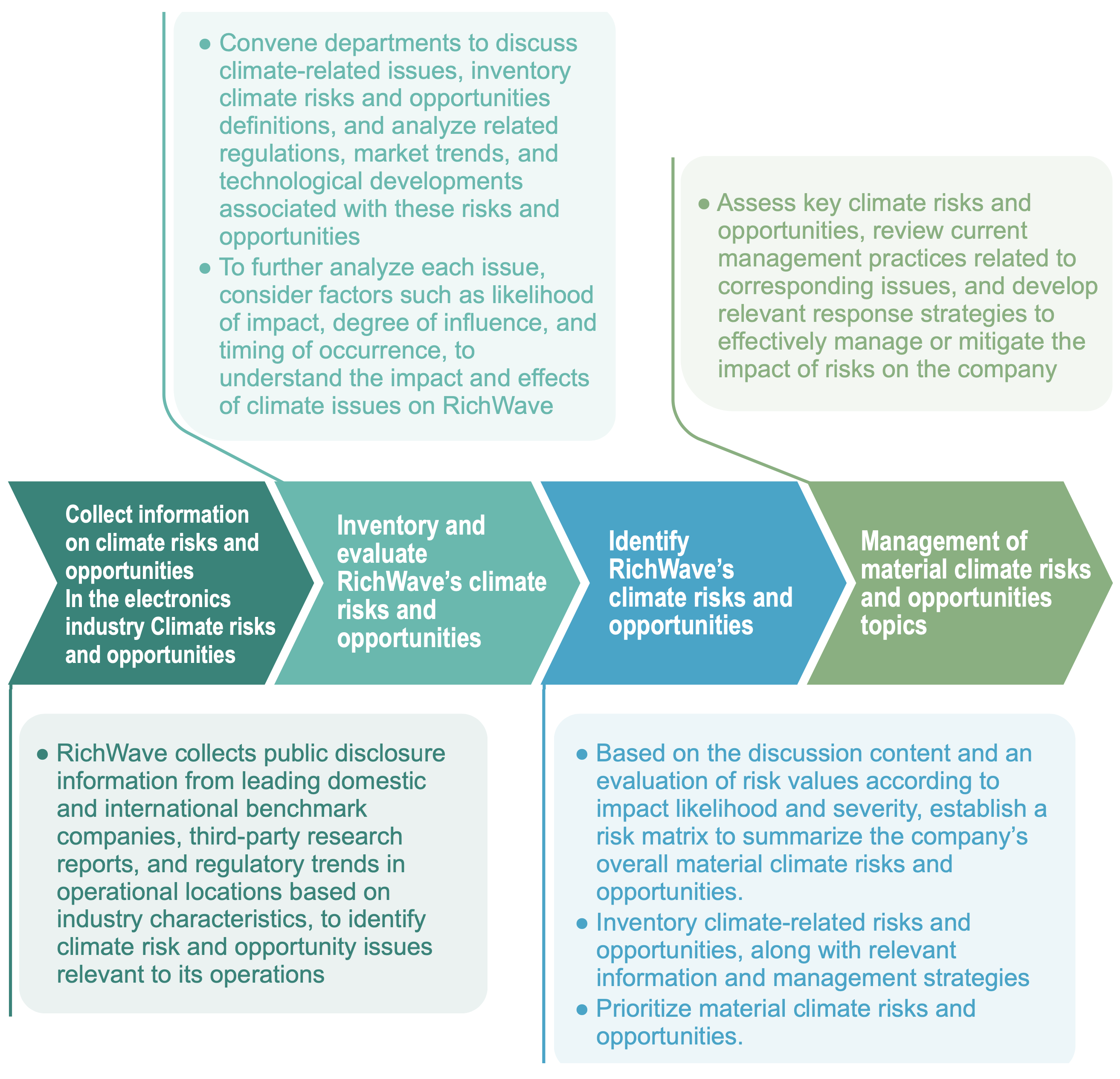

RichWave has established a comprehensive BCP model to evaluate the company's potential risks through relevant risk identification procedures, including policy, regulatory, and technology- related dimensions, as well as propose corresponding responses to address material risks. Our climate risk management is based on the RichWave's BCP model. After each business unit identifies significant climate risks and opportunities, the Climate Change Response Team formulates corresponding strategies and measures to address material risk and opportunity issues, which are managed through the company's BCP risk organizational structure. Using the abovementioned mechanism, RichWave progressively incorporates climate risk management into the company's general risk management system, where climate topics are integrated into routine management to make sure that climate risks are effectively supervised and responded to.

RichWave's key climate risk and opportunity evaluation procedure

3. Strategy

1. Identification of Material Climate Risks and Opportunities

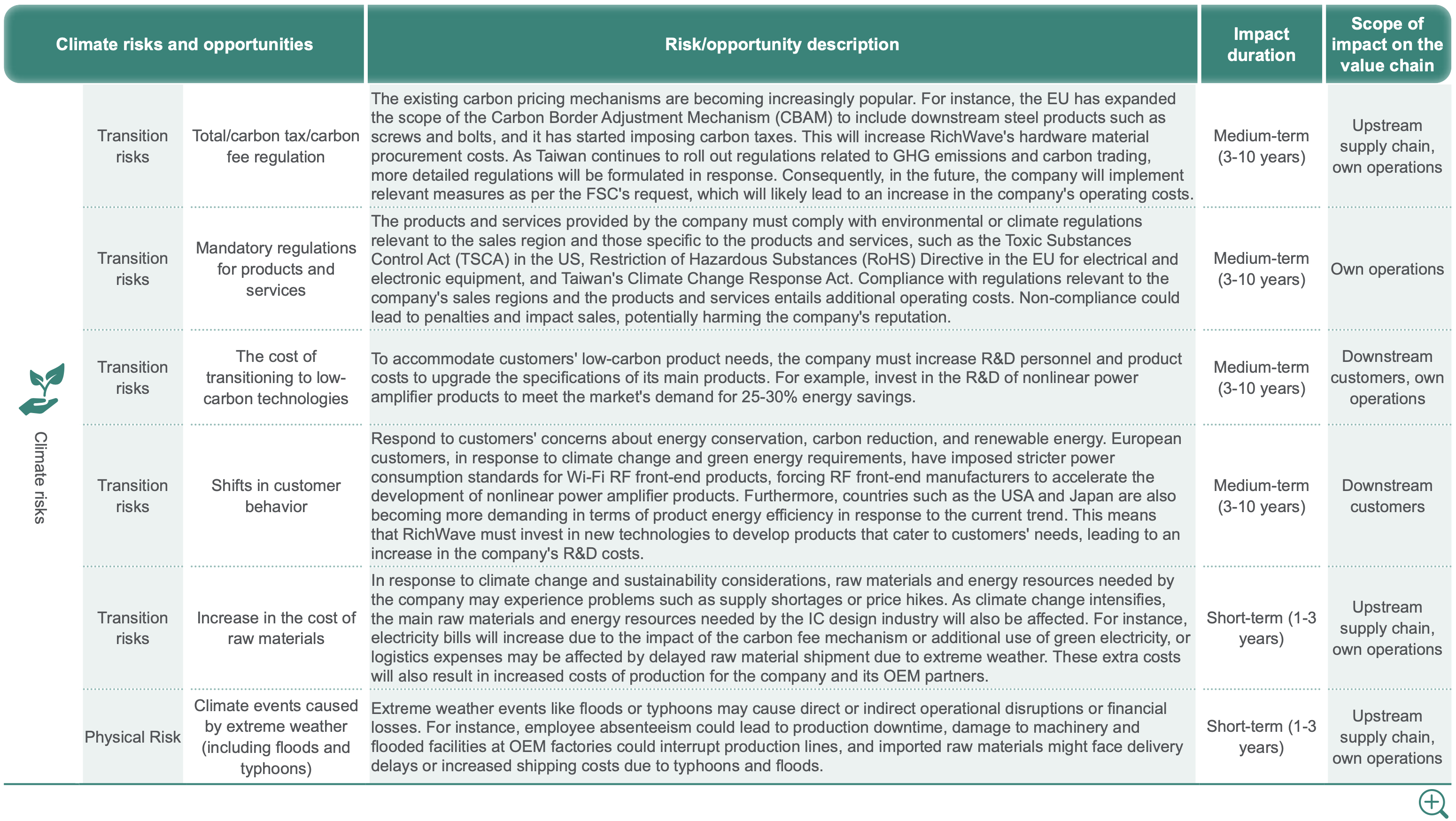

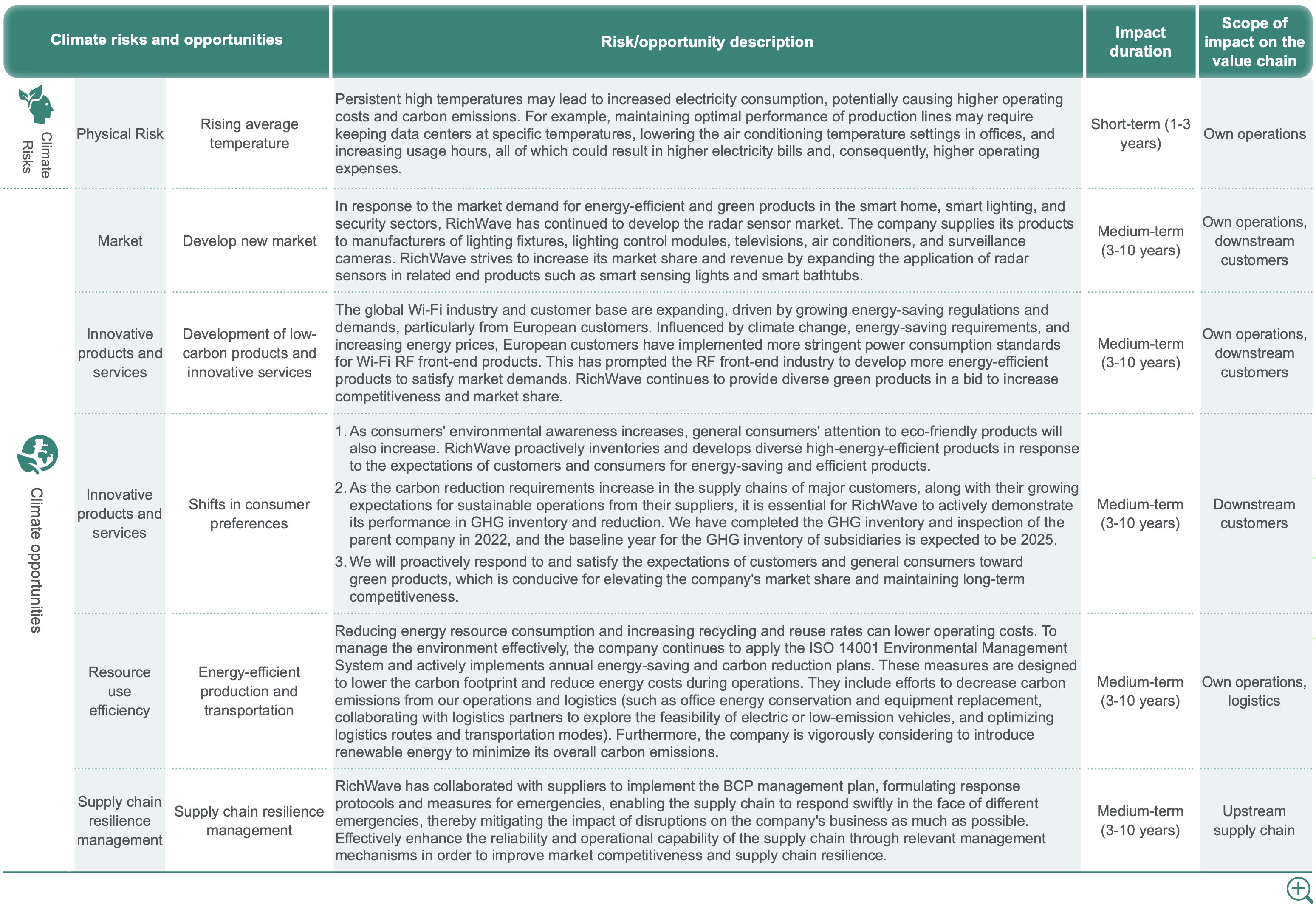

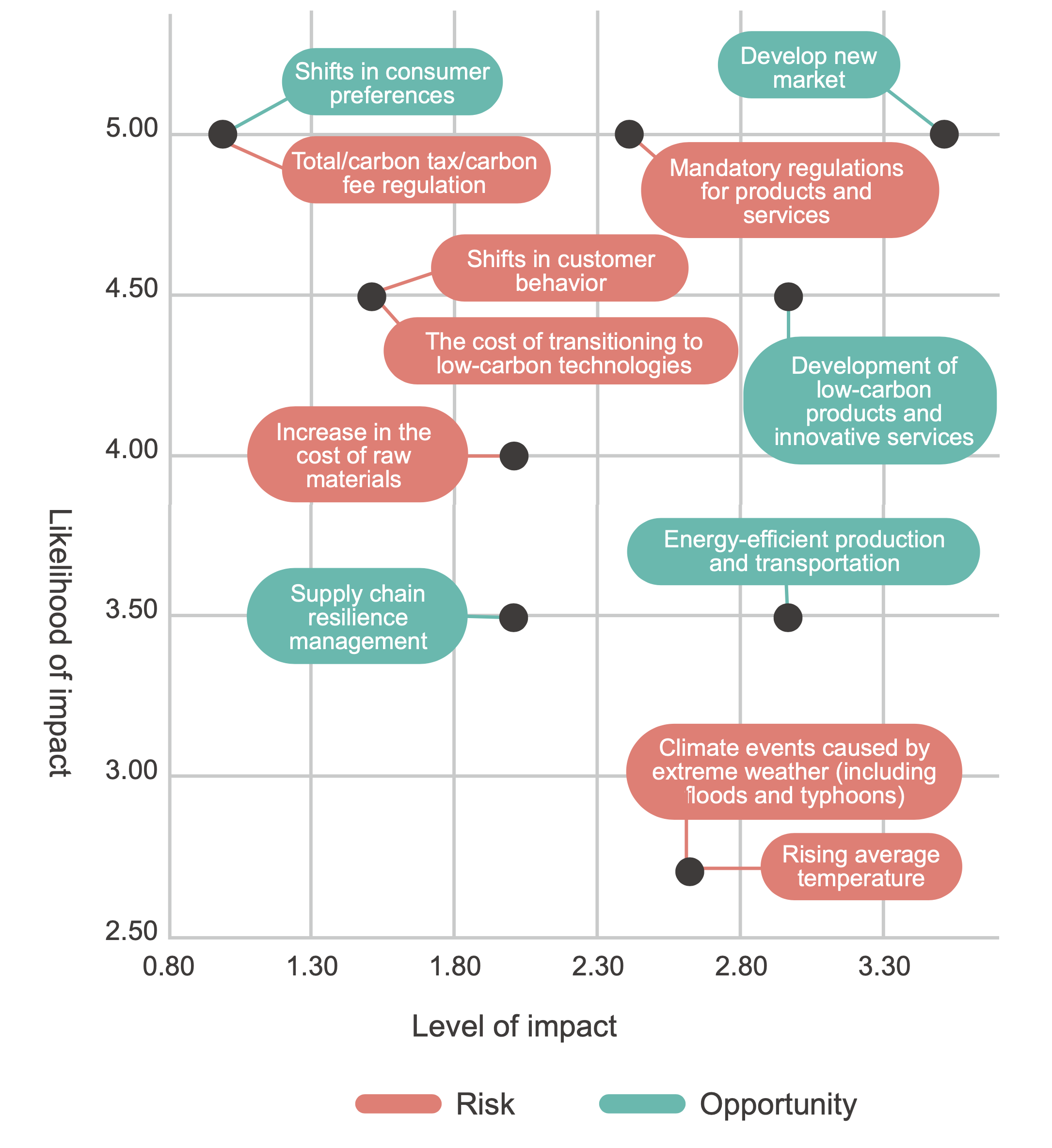

In 2023, we evaluated the industry characteristics and trends of RichWave based on the current operations of each department. We also explored various development strategies and taken into consideration local regulatory trends and geographical characteristics of our business locations. We preliminarily identified 12 risks and opportunities relevant to RichWave, including 5 transition risks, 2 physical risks, and 5 opportunity topics.

RichWave's Material Risks and Opportunities

2. RichWave's Material Cimate Risks and Opportunities

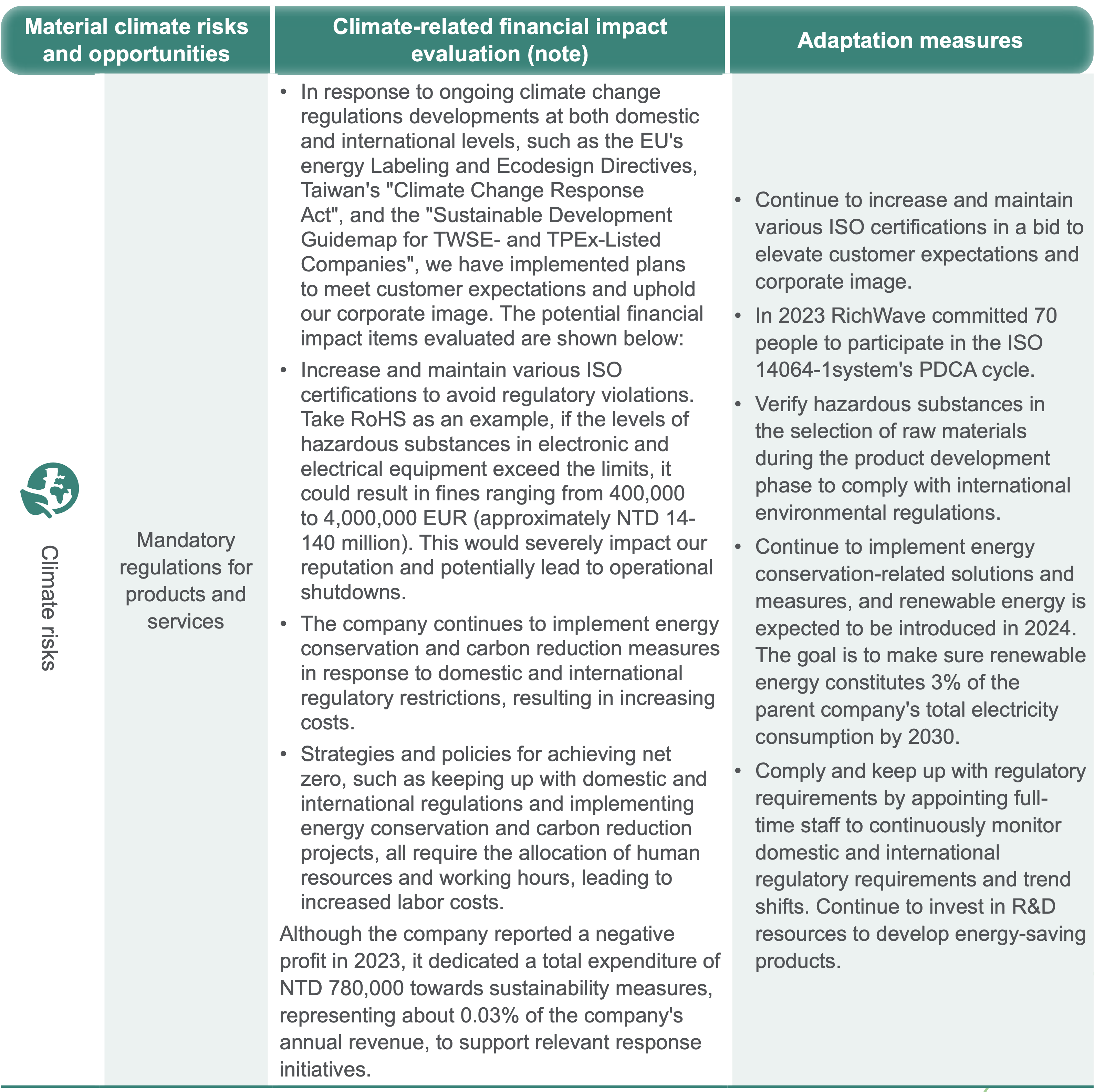

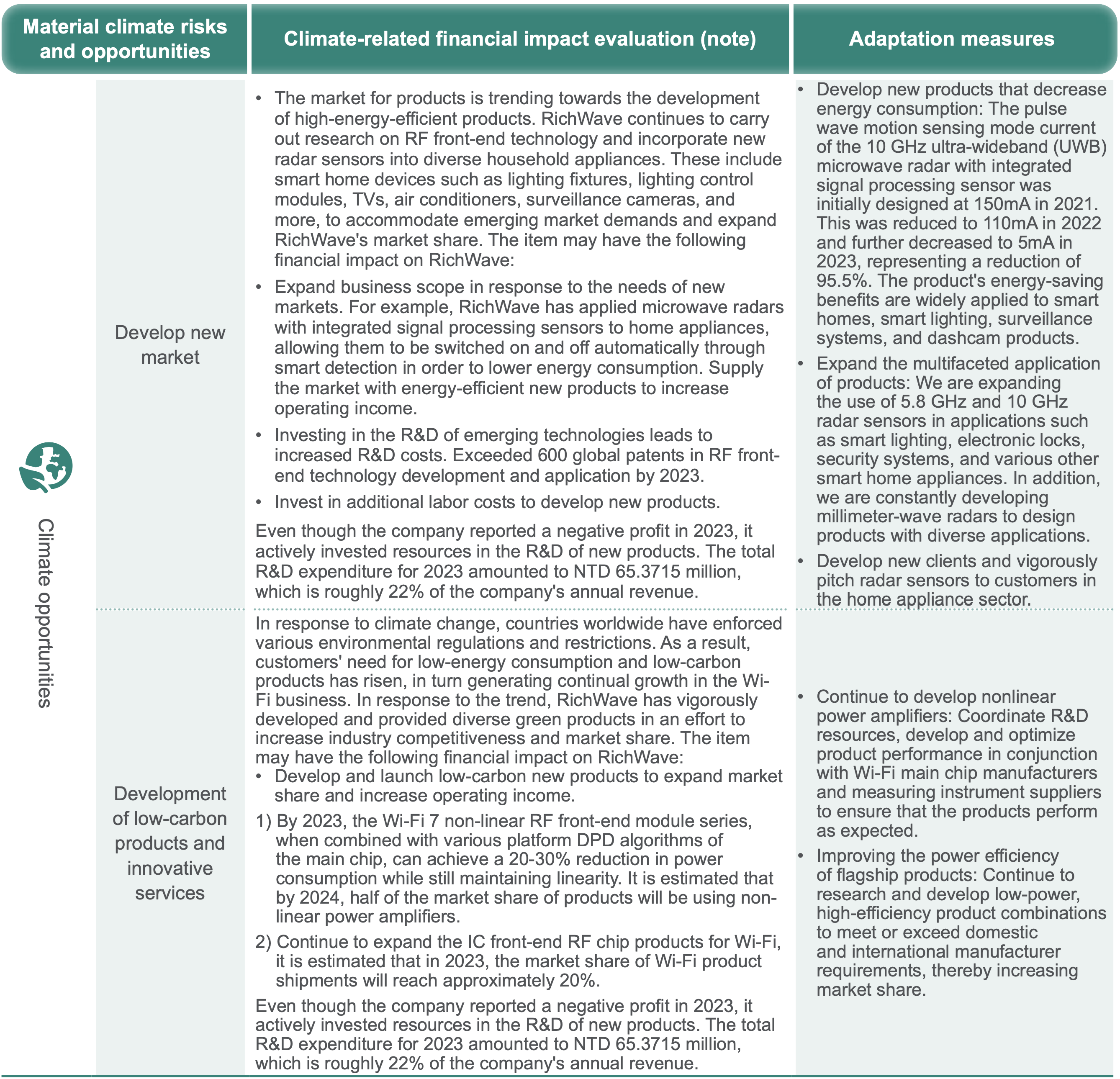

The 3 material climate risks and opportunities identified by RichWave this year are developing new markets, low-carbon products and innovative services, and mandatory regulations for products and services. We explore the material impact of various risks and opportunities based on the current market conditions, international trends, and other external research reports, to analyze past and future potential material impacts, as well as review our resources and future business development conditions, and propose corresponding response strategies.

Please see the following table for the financial impact evaluation and adaptation measures of RichWave's material climate risks and opportunities:

RichWave's TCFD Risk-Opportunity Matrix

Note:

Note:

- The outcome of climate-related financial impact analysis can vary depending on the assessment scope, scenario assumptions, data scope, and data availability. Please evaluate the applicability of the data with caution when citing the data.

- Euro exchange rate is estimated at 1:35.

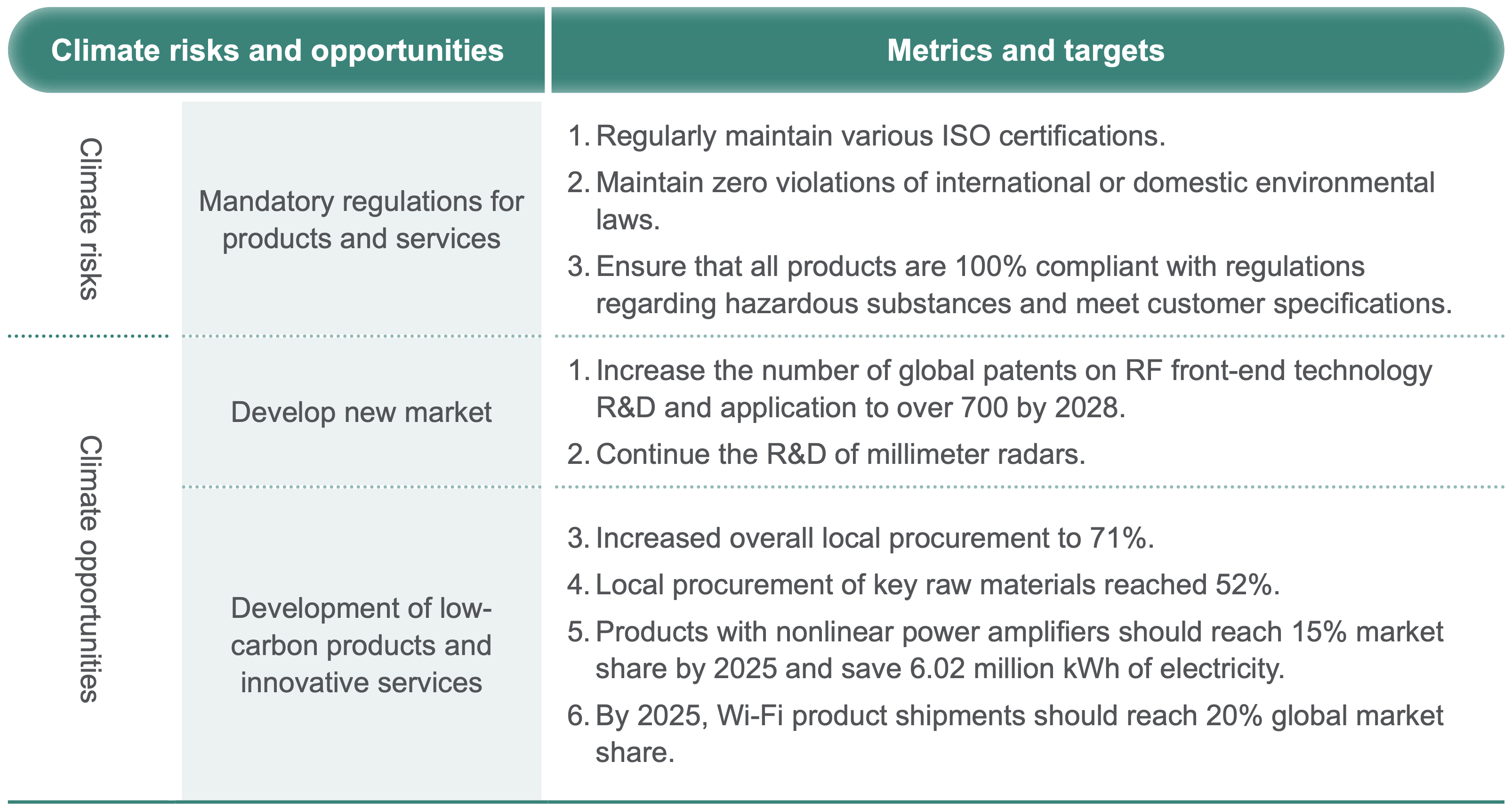

4. Metrics and Targets

In response to climate change-related opportunities and risks, RichWave has formulated corresponding management metrics and targets, and regularly reviews the development conditions of material climate risks and opportunities. We have stipulated carbon reduction, electricity-saving, and waste reduction targets based on important climate-related environmental metrics. Furthermore, we plan to use renewable energy to minimize climate risks within our operations. We aim to further expand the climate management topic to the supply chain in a bid to strive for environmental sustainability with our suppliers. We will monitor the achievement of various metrics and report it to the Board of Directors, which will guide the company to engage in continual optimization and improvement to foster its climate resilience amid the global trend of climate change.

Overall metrics and targets

- RichWave is committed to formulating water- saving and electricity-saving policies every year. We have set a target to decrease electricity consumption, GHG emissions, and waste by 3% within 5 years and lower WUI by 2% compared to 2023 before 2030, as well as conduct regular performance monitoring and target adjustments to ensure alignment with environmental changes and risk management needs.

- Vigorously encourages the supply chain to obtain ISO certifications for carbon emissions and energy management, enabling suppliers to strive for environmental sustainability with RichWave and ensuring that the green development of the overall supply chain conforms to international standards.

- We plan to gradually increase the use of renewable energy within the next 5 years by participating in the renewable energy power trading market and establishing a renewable energy utilization strategy to materialize the long-term objective of environmental sustainability. We expect to increase renewable energy utilization to 3% by 2030 and use up to 18,000 kWh of renewable energy by 2025.

GHG Management

Operational GHG Management

Faced with global climate change, RichWave has not only vigorously adopted a wide range of response measures but also strives to mitigate GHG emissions. RichWave belongs to the IC R&D and design industry, and the significant source of emissions is the use of purchased electricity. In this regard, RichWave has adopted the ISO 14064-1:2018 greenhouse gas management system since June 2022, and has passed the international certification in November of the same year, and will adopt the operation control right method to conduct a greenhouse gas inventory with 2021 as the base year and actively promote various greenhouse gas emission reduction measures based on the results of the inventory. Through continuous improvement plans and measures, we will reduce greenhouse gas emissions within the scope of our operations and fulfill our corporate social responsibility. Starting in 2023, we plan to set a 3% reduction target over the next 5 years as the goal for our GHG emissions management policy.

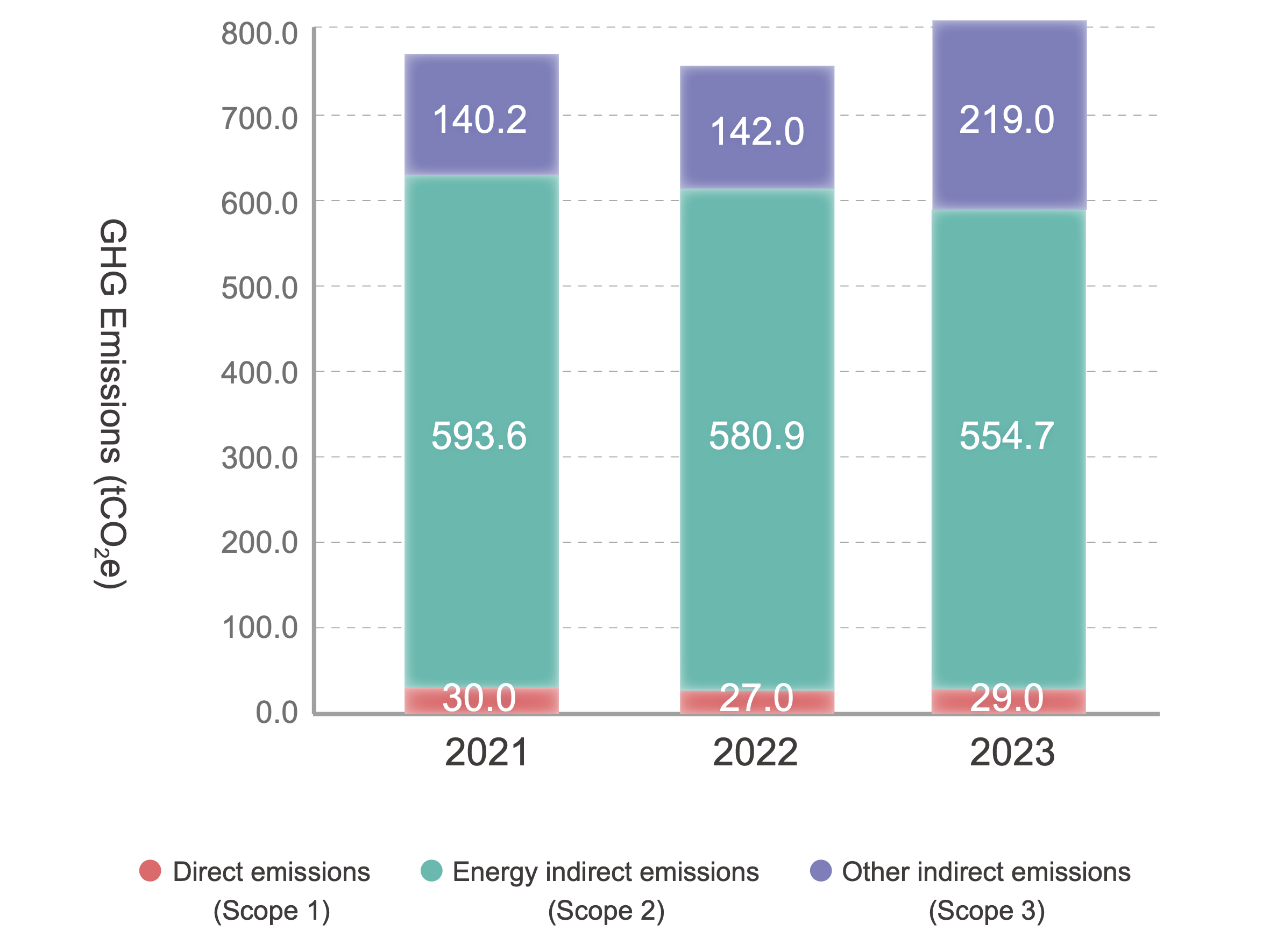

In 2023, RichWave's Scope 2 GHG emissions amounted to 554.6735 tCO e, representing a 4.5% decrease from 2022. The emission intensity for Scope 1 and Scope 2 combined was 0.19562tCO per NTD million revenue, primarily 2 due to implementing diverse energy-saving initiatives and incentive policies. Collaborative efforts across departments including laboratories,data centers,product storage facilities, environmental safety, and administration led to the implementation of 4 energy-saving projects and 6 improvement measures in 2023. For further details, please refer to 5.2 Energy Management. To decrease GHG emissions during our business operation, RichWave has pro- actively implemented various energy-saving solutions (for details of specific measures, please refer to the "Green Operations"chapter) to gradually achieve the greenhouse gas reduction target.

RichWave's GHG Emissions over the Last 3 Years

Note:

Note:

- The greenhouse gas inventory was conducted in accordance with ISO 14064- 1:2018 using the operational control method, and the global warming potential (GWP) of various greenhouse gases was calculated based on the IPCC AR6 announcement after selecting the emission factors in accordance with the "EPA Greenhouse Gas Emission Factor Management Table 6.0.4".

- Scope 3 emission categories include Category 3 and Category 4. Emission activities encompass downstream product transportation, employee commuting, raw material extraction, manufacturing, and processing, as well as the disposal of solid and liquid waste. As of 2022, upstream product transportation has been included.

- In 2022, the GHG emissions were revised based on the third-party verification results on 2023/10/27. The Scope 2 emissions were adjusted from 597.1313 tCO2e to 580.9381 tCO2e, and the Scope 3 emissions were revised from 142.9742 tCO2e to 141.9830 tCO2e. The verification opinion was issued without any reservations.

- The 2023 GHG emissions statistics in the report will be adjusted according to the third-party verified data in Q3 of 2024.

Other Indirect Ghg Emissions Management

RichWave's business operations include IC R&D, design and sales, where product manufacturing is completely reliant on the processing of our supply chain partners. The supply chain is an important link in mitigating product life cycle carbon emissions, hence we stress scope 3 GHG management and vigorously promote the reduction of GHGs outside of the organization's business scope. Through continuous refinement, increasing the performance of our high-power, energy-efficient products, and implementing supply chain energy management, we can minimize the carbon footprint of various terminal electronic products. In doing so, the company will be able to attain the sustainability of energy resources on the planet while offering consumers high-performance, high- quality products.

1) Green Product Design

We have taken the environmental impact of the products' life cycle during the IC design stage and continue to facilitate innovations in energy-saving designs. Besides effectively reducing energy consumption during the production process and lowering production costs, RichWave can also decrease energy consumption while using the products, thereby mitigating production/consumption costs with our suppliers and consumers, as well as cherishing the Earth and engendering a green, sustainable future.

2) Supply Chain Carbon Management

To promote supply chain carbon reduction, we have demanded our suppliers obtain international quality certifications such as ISO 9001/ISO 14001/ISO 45001/QC 080000/IATF 16949 to prevent the production process's negative impact on the environment. In addition, we have conducted an audit of our 20 primary suppliers across the 3 categories of wafer, packaging and testing to make sure that they comply with the local environmental laws, as well as to engage in ongoing improvements in terms of energy conservation and GHG emissions reduction. Also, the zero- carbon objective and action plan guidelines for 2030 and 2050 have been formulated.

3) Green Transportation

In terms of the daily commute, we encourage our colleagues to make use of public transport or carpool; in terms of business travel, besides asking our colleagues to utilize public transport, they are encouraged to conduct meetings using the video conferencing system to minimize carbon emissions from transportation.