Home / ESG / Management Governance

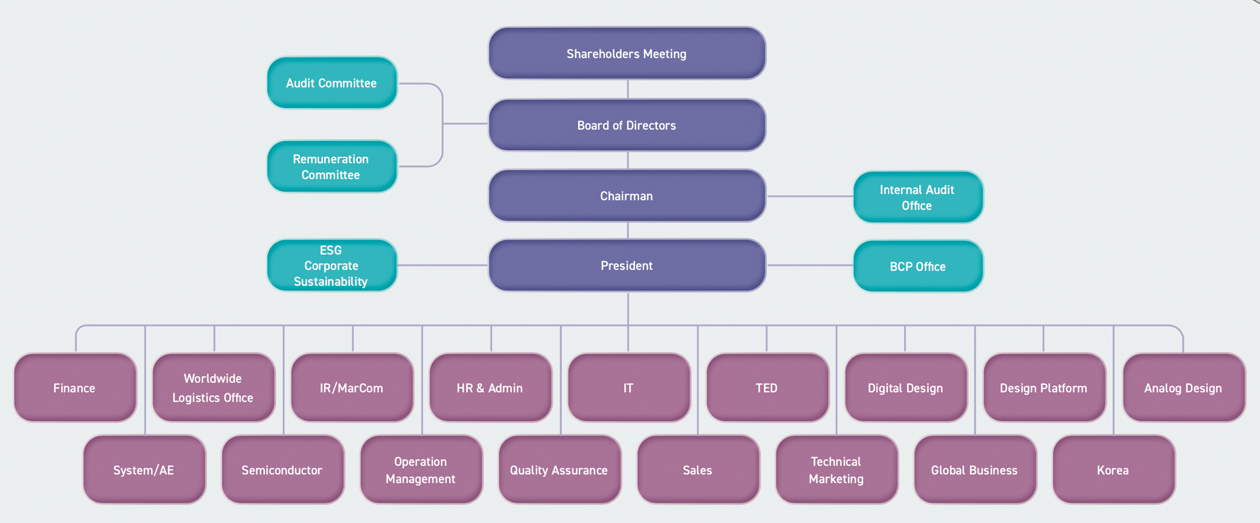

Corporate Governance Structure

A sound corporate governance system is the key to sustainable corporate management, and a well- functioning Board of Directors is not only the cornerstone of outstanding corporate governance but also facilitates the company’s sustainable development. RichWave has formulated the “Corporate Governance Best-Practice Principles” to reinforce the Board of Directors’ functions, protect the shareholders’ equity, and respect the stakeholders’ rights. Furthermore, the “Articles of Incorporation” regulate the selection and formation of the Board of Directors. The Audit Committee and Remuneration Committee subsidiary to the Board of Directors are responsible for fortifying the independence of corporate governance and enhancing the company’s remuneration system.

Operation of the Board of Directors

RichWave has appointed 7–9 directors according to the Articles of Incorporation. Adopting the candidate nomination system, the directors are selected from the roster of director candidates by the shareholders’ meeting, and they may be reelected. In particular, there shall be more than three independent directors and should make up for no less than 1/5 of the directors’ seats, serving a term of 3 years. The Board of Directors will exercise its powers according to the law, the Articles of Incorporation, and decisions made by the shareholders’ meeting. The board of directors of our company is composed of members with diverse backgrounds in management, science and technology, accountancy and finance, and law. There are industry executives, professors specializing in science and technology, as well as accounting professors and lawyers, all of whom bring diverse perspectives and expertise. The board members provide professional guidance to direct the company's strategies, supervise management to ensure sustainable performance, and safeguard the rights and interests of stakeholders. RichWave’s Board of Directors has nine directors, consisting of five directors and four independent directors.

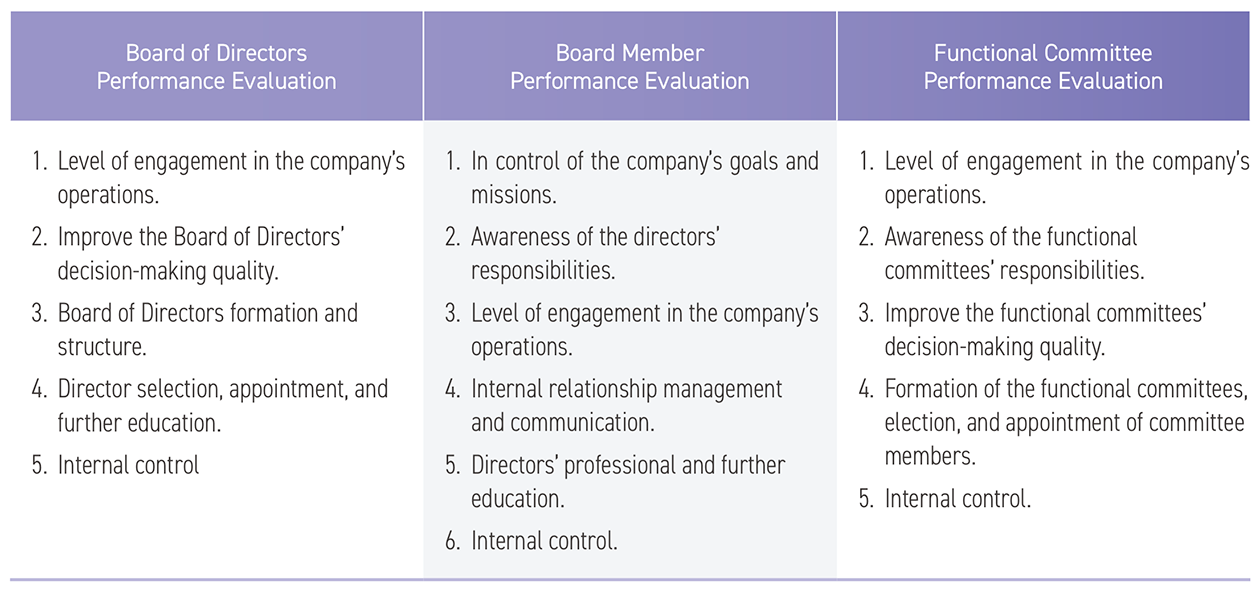

In order to effectively implement corporate governance and improve the efficacy of the board of directors, our company annually enrolls directors in external training programs. In 2023, reappointed directors received a minimum of 6 training hours. This satisfies the requirements for director training hours. The training covers topics pertaining to the economy, the environment, and society, such as corporate governance, regulatory compliance and internal controls, impact investing, supply chain cybersecurity management, sustainability and carbon neutrality, climate change, and TCFD-related climate financial disclosure. Additionally, the board of directors is evaluated annually by the company. A questionnaire is used to assess the overall operations of the board of directors and functional committees, board participation, understanding of the company, awareness of responsibility, and continuing education. The evaluation functions as a guide for board members' ongoing development. On February 23, 2023, the performance evaluation for the year 2022 was concluded, and the result was outstanding.

The Board of Directors convenes regularly every year to discuss the company's material issues. In 2023, the Board of Direcotrs convened 5 meetings, achieving an attendance rate of 98%.

Functional Committees

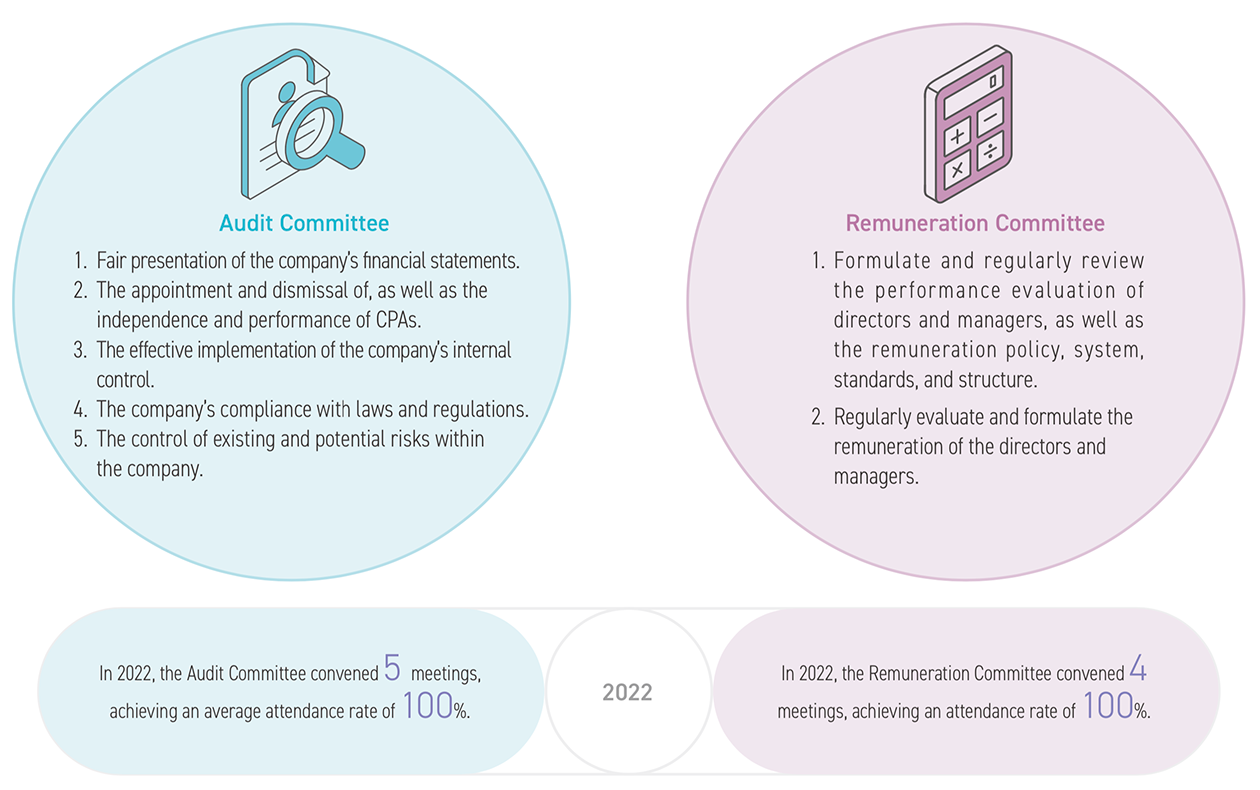

The company has established an Audit Committee and a Remuneration Committee under the Board of Directors to assist the board in fulfilling its responsibilities of strategic leadership and carrying out its supervisory function. The Audit Committee consists of independent directors who are in charge of supervising the hiring (dismissal) of the company’s CPA, internal control effectiveness, legal compliance status, and performing potential risk control. In addition, RichWave has formulated the Audit Committee organizational regulations, stipulating that Audit Committee meetings must be conducted at least once every quarter, and the meeting may be convened at any time if necessary. In 2023, the Audit Committee convened five meetings, achieving an average attendance rate of 100%.

The company’s Remuneration Committee is also made up of four independent directors who propose recommendations concerning the remuneration of directors and managers to the Board of Directors from an independent, objective point of view. The recommendations serve as a reference for the Board of Directors during its decision-making process. According to the company’s Remuneration Committee organization regulations, at least two Remuneration Committee meetings should be convened annually, and the meeting can be convened at any time if necessary. In 2023, the Remuneration Committee convened three meetings, achieving an attendance rate of 100%.

The company's remuneration policy for directors and senior management is established based on industry standards and practices regarding remuneration. This includes considering the practices, standards, composition, and procedures for determining remuneration. The process involves referencing the salary levels of peer companies and receiving recommendations from the Remuneration Committee before presenting them to the Board of Directors for approval. The following mechanisms are in place:

◆Directors:

The remuneration of directors is derived from the distribution of profits, with the allocation of profits for their remuneration not exceeding 1%. The remuneration is assessed according to the level of involvement and contributions made by the directors to the company's operations. When the company achieves net income in its annual financial statements, after accounting for losses, allocating statutory surplus reserves or special surplus reserves, and distributing dividends to special stockholders and employee remuneration, the Board of Directors shall assess the industry environment and the company's capital requirements. The company will propose a profit distribution plan that includes remuneration for the directors. This plan will be distributed after receiving approval from the shareholders' meeting.

◆President and Vice President:

The remuneration for the President and Vice President comprises salary, bonuses, and employee dividends. The determination is based on the positions held, responsibilities undertaken, performance evaluation, contributions to the company, and the achievement of sustainability (ESG) indicators such as ISO14001 and ISO14064- 1 certification. The remuneration also considers industry benchmark.